Explaining the logic of securities trading while integrating emotional factors.

Let us say you find a popular restaurant with a long line of people waiting to get in right next to an empty and quiet restaurant. Which would you choose if you were to have lunch?

Most people will choose the former, not because of the taste of what the store serves but because of the long line that formed outside it. People do not logically determine their own actions; rather, they find comfort in doing the same actions as others, and thus tend to follow. “These actions are called the ‘herding phenomenon’ in behavioral economics. Many stock market investors do not consider each stock thoroughly; they rush to buy certain stocks simply because ‘everyone is buying these stocks.’ Even the issues relating to the bankruptcy of the Lehman Brothers, which brought about a global financial crisis, is considered the result of a herding phenomenon, in which people overheated the market as they bought subprime loan-based products.” Jie Qin, who is interested in and has explained the herding phenomenon, is an expert in behavioral finance; he has published many research findings on the subject. What is particularly unique about Qin’s study is that he brought emotions in on securities market analysis.

“Traditional investment theories were constructed based on the notion that investors would make rational decisions, and thus they did not consider emotional factors. However, it is clear from the studies in neuroscience and psychology that emotion plays a significant role in decision making.” Among all possible emotions that one can feel, Qin focuses on regret and has analyzed the impact it can have on the stock market. The securities trading model that he constructed, which incorporates regret factor, had a momentous impact globally as such factor was not included in prior theories.

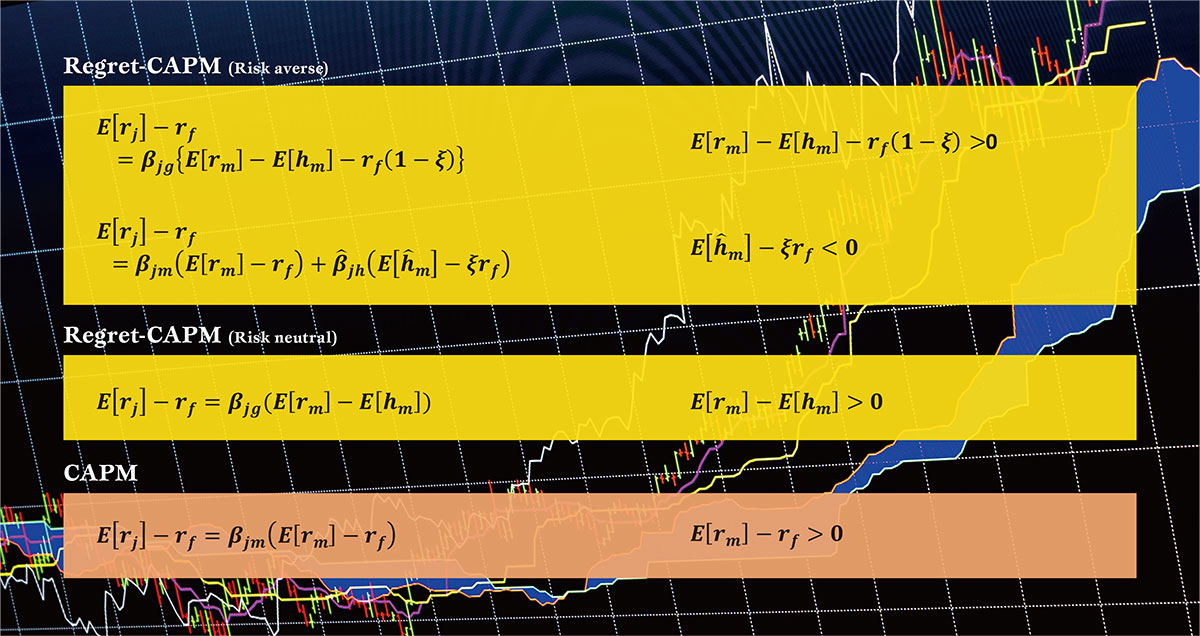

Qin’s Regret-CAPM (Top and Middle). He incorporated the emotion of regret into the traditional CAPM (Bottom).

Of all the negative emotions, Qin decided to focus on regret because he thought it would influence decision making. He then began to theorize what would happen if we look at the herding phenomenon while considering the effect of regret. Qin illustrated, “suppose that there were two types of investors, bullish and bearish ones.” If each makes objective decisions based on information he or she possesses and acts reasonably in the securities market, the stock price and its asset values should hold the right balance. “On the contrary, if we consider the effect of regret, bearish investors fear that they may make the wrong decision and thus will exit the market, leaving only the bullish investors in the market. This will cause the stock prices to surge as the buy orders will increase. With that said, at this point, the trade volume will not be that high. However, the sense of regret is a feeling that comes into play not only when the investors take the wrong action but also when they take no action. In other words, once bearish investors who exited the market find that the stock prices have increased, they start to believe that ‘if they don’t buy now, they might regret it,’ and thus return to the market. This would result in a greater number of buys, which then creates the bubble. The opposite of this phenomenon is a crash, the bursting of the bubble.” Qin created a mathematical model to explain this chain of events. He is the first in the world to logically explain the herding phenomenon using the emotional factor called regret. Qin is also the only person who managed to create a model that considers both regret in making a wrong investment and regret of not making any investment.

Next, Qin focused on the relation between risk and return of individual stocks and analyzed how regret affects the process in which investors expect return to be formed. “Currently, the most widely accepted premise in analyzing risk and return is a theory called the Capital Asset Pricing Model (CAPM),” Qin explained. When you use information from a capital market where opinions from many investors are aggregated, the capital cost or the expected rate of return will typically show up as high-risk high-return. Qin decided to integrate regret factor into the CAPM to build a new mathematical model. This is the first theoretical model that incorporates regret into the equilibrium price. He stated, “Although there is room for refinement and expansion, this is an important first step toward a new direction.”

Qin stated that “even (Harry) Markowitz, who is a Nobel prize winner for economic science and a founder of modern investment theories, mentioned that he divided his pension into bonds and stocks evenly, as he was afraid that he might regret not doing so.” Although using a unique analogy to demonstrate how emotion can significantly influence a person’s activities, he advocates the need to incorporate emotional factors into securities investment research. “In the field of neuroscience, many reports state that those who lost their emotional faculty due to brain damage are unable to make rational decisions. In our decision-making processes, both our brain, as the hardware, and emotions, as its software, are indispensable. My research serves only to remind others of the need to consider emotions in considering all aspects of finance.” We expect that Qin’s research will open new territories in financial research.

- Jie Qin

- Professor, College of Economics

- Research Subject: behavioral finance, neuroeconomics

- Research Keywords: regret, emotion and markets, herding, crash